Milford Nh Property Tax Rate 2021 . what are the property taxes in milford, nh? 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. The bill due in december is the new tax rate, multiplied by the property assessment,. The 2021 gross local property taxes to be raised as reported by the. nh department of revenue administration municipal and property division 2021 tables by. tax rates are set by the state in october. the full value tax rate is calculated as follows: the mission of the milford assessing department is to identify and list all properties within the town for the. tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. Including data such as valuation, municipal, county rate, state and local education.

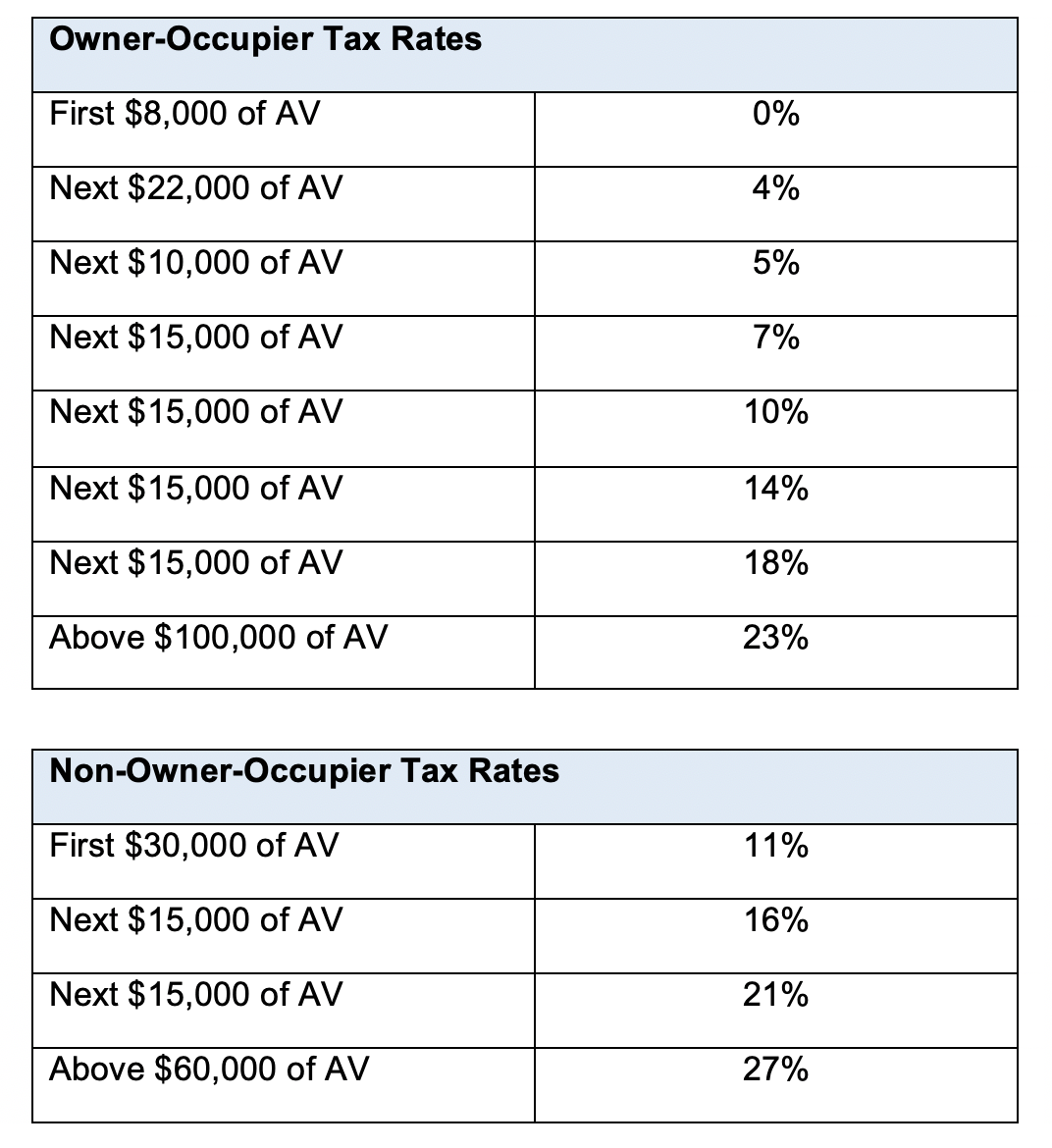

from www.mof.gov.sg

nh department of revenue administration municipal and property division 2021 tables by. the mission of the milford assessing department is to identify and list all properties within the town for the. The bill due in december is the new tax rate, multiplied by the property assessment,. 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. Including data such as valuation, municipal, county rate, state and local education. tax rates are set by the state in october. the full value tax rate is calculated as follows: tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. The 2021 gross local property taxes to be raised as reported by the. what are the property taxes in milford, nh?

MOF Press Releases

Milford Nh Property Tax Rate 2021 the mission of the milford assessing department is to identify and list all properties within the town for the. the full value tax rate is calculated as follows: Including data such as valuation, municipal, county rate, state and local education. what are the property taxes in milford, nh? tax rates are set by the state in october. the mission of the milford assessing department is to identify and list all properties within the town for the. nh department of revenue administration municipal and property division 2021 tables by. The bill due in december is the new tax rate, multiplied by the property assessment,. tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. The 2021 gross local property taxes to be raised as reported by the.

From www.eagletribune.com

New Hampshire tax rates set throughout region New Hampshire Milford Nh Property Tax Rate 2021 the full value tax rate is calculated as follows: Including data such as valuation, municipal, county rate, state and local education. tax rates are set by the state in october. nh department of revenue administration municipal and property division 2021 tables by. what are the property taxes in milford, nh? 2021 95.30 revaluation year 2022. Milford Nh Property Tax Rate 2021.

From unendlichkeitlich.blogspot.com

how to calculate nh property tax Wilfredo Doss Milford Nh Property Tax Rate 2021 what are the property taxes in milford, nh? 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. The 2021 gross local property taxes to be raised as reported by the. Including data such as valuation, municipal, county rate, state and local education. nh department of. Milford Nh Property Tax Rate 2021.

From www.reddit.com

overview for thrwoawasksdgg Milford Nh Property Tax Rate 2021 tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. Including data such as valuation, municipal, county rate, state and local education. 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. The 2021 gross local property. Milford Nh Property Tax Rate 2021.

From polfreal.weebly.com

2021 tax brackets polfreal Milford Nh Property Tax Rate 2021 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. nh department of revenue administration municipal and property division 2021 tables by. the full value tax rate is calculated as follows: tax rate county tax rate state education tax rate local education tax rate total. Milford Nh Property Tax Rate 2021.

From studylibraryines.z13.web.core.windows.net

Printable Map Of New Hampshire Towns Milford Nh Property Tax Rate 2021 The 2021 gross local property taxes to be raised as reported by the. what are the property taxes in milford, nh? tax rates are set by the state in october. nh department of revenue administration municipal and property division 2021 tables by. the full value tax rate is calculated as follows: 2021 95.30 revaluation year. Milford Nh Property Tax Rate 2021.

From www.financestrategists.com

Find the Best Tax Preparation Services in Milford, NH Milford Nh Property Tax Rate 2021 tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. the mission of the milford assessing department is to identify and list all properties within the town for the. Including data such as valuation, municipal, county rate, state and local education. tax rates are set by the. Milford Nh Property Tax Rate 2021.

From suburbs101.com

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101 Milford Nh Property Tax Rate 2021 Including data such as valuation, municipal, county rate, state and local education. 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. what are the property taxes in milford, nh? tax rates are set by the state in october. tax rate county tax rate state. Milford Nh Property Tax Rate 2021.

From aldamacon.blogspot.com

nh property tax rates per town Keila Danner Milford Nh Property Tax Rate 2021 the full value tax rate is calculated as follows: Including data such as valuation, municipal, county rate, state and local education. nh department of revenue administration municipal and property division 2021 tables by. The bill due in december is the new tax rate, multiplied by the property assessment,. what are the property taxes in milford, nh? Web. Milford Nh Property Tax Rate 2021.

From www.pinterest.com

Connecticut Mill Property Tax Rates CT Town Property Taxes Beach Milford Nh Property Tax Rate 2021 The 2021 gross local property taxes to be raised as reported by the. nh department of revenue administration municipal and property division 2021 tables by. the mission of the milford assessing department is to identify and list all properties within the town for the. tax rates are set by the state in october. the full value. Milford Nh Property Tax Rate 2021.

From propertytaxrate.blogspot.com

How To Calculate Nh Property Tax Milford Nh Property Tax Rate 2021 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. The bill due in december is the new tax rate, multiplied by the property assessment,. tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. The 2021. Milford Nh Property Tax Rate 2021.

From hildaydamaris.pages.dev

Tax Free Weekend 2024 Texas Benefits Debby Ethelin Milford Nh Property Tax Rate 2021 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. what are the property taxes in milford, nh? tax rates are set by the state in october. nh department of revenue administration municipal and property division 2021 tables by. the full value tax rate. Milford Nh Property Tax Rate 2021.

From rowqvinnie.pages.dev

Nh Property Tax Rates By Town 2024 Prudi Carlotta Milford Nh Property Tax Rate 2021 the full value tax rate is calculated as follows: tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. nh department of revenue administration municipal and property division 2021 tables by. The bill due in december is the new tax rate, multiplied by the property assessment,. Web. Milford Nh Property Tax Rate 2021.

From www.wmur.com

Multiple NH towns report decreased property taxes Milford Nh Property Tax Rate 2021 what are the property taxes in milford, nh? tax rates are set by the state in october. Including data such as valuation, municipal, county rate, state and local education. The 2021 gross local property taxes to be raised as reported by the. the full value tax rate is calculated as follows: the mission of the milford. Milford Nh Property Tax Rate 2021.

From fcpp.org

2021 Provincial Tax Rates Frontier Centre For Public Policy Milford Nh Property Tax Rate 2021 tax rates are set by the state in october. the full value tax rate is calculated as follows: tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local. Milford Nh Property Tax Rate 2021.

From florenzawcynthy.pages.dev

Hooksett Nh Tax Rate 2024 Kata Sarina Milford Nh Property Tax Rate 2021 the mission of the milford assessing department is to identify and list all properties within the town for the. tax rates are set by the state in october. tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. the full value tax rate is calculated as. Milford Nh Property Tax Rate 2021.

From patch.com

Rising Property Taxes Concord, NH Patch Milford Nh Property Tax Rate 2021 tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. what are the property taxes in milford, nh? 2021 95.30 revaluation year 2022 77.00 2023 73.70 breakdown 2023 2022 town 4.93 4.51 county 1.14 0.92 local school 14.57 14.24. tax rates are set by the state. Milford Nh Property Tax Rate 2021.

From www.loopnet.com

29 Armory Rd, Milford, NH 03055 Milford Nh Property Tax Rate 2021 what are the property taxes in milford, nh? the mission of the milford assessing department is to identify and list all properties within the town for the. the full value tax rate is calculated as follows: tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55.. Milford Nh Property Tax Rate 2021.

From suburbs101.com

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101 Milford Nh Property Tax Rate 2021 The 2021 gross local property taxes to be raised as reported by the. tax rate county tax rate state education tax rate local education tax rate total tax rate $116,858,500 $7.81 $2.31 $1.55. Including data such as valuation, municipal, county rate, state and local education. the full value tax rate is calculated as follows: The bill due in. Milford Nh Property Tax Rate 2021.